Your auto insurance is your first line of defense against a wide variety of mishaps ranging from vandalism to multiple-vehicle collisions. That is why you need to make sure that every vehicle you own has the proper coverage at all times.

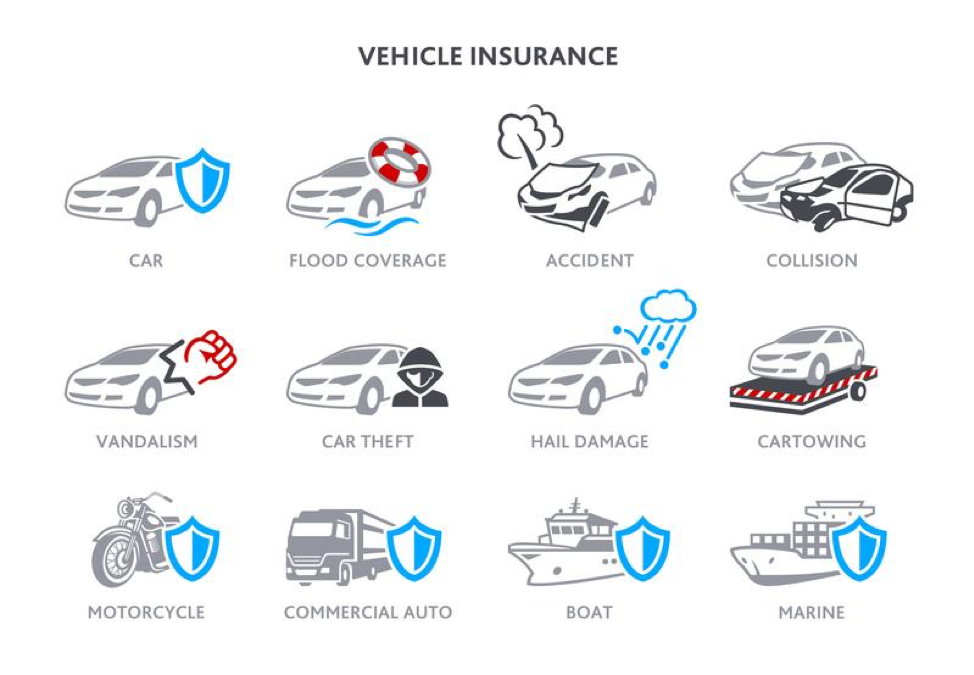

Many people think of their car or primary form of transportation when they think of ‘vehicle insurance.’ However, every vehicle you own deserves insurance in the case of damage. Be sure to check out our line of powerful insurance options for each of your vehicles.

Here is a closer look at some of the laws regarding auto and watercraft insurance policies.

Daily Drivers

When it comes to insuring your cars, your daily driver should always come first. Almost every state requires you to have coverage in the case of a crash or other accident. You might also need liability coverage to protect your assets in the event of a major collision or legal battle. Your policy should cover expenses such as auto repairs, replacing a totaled vehicle, damage to city property, and medical bills.

More: https://www.firststatelawyers.com/dover-car-accident-lawyer/

Recreational Vehicles

Many RV owners don’t realize that they need special coverage for their recreational vehicles. In addition to basic liability insurance, you also need to cover some of the possessions that are inside your RV.

Replacing damaged generators or stolen solar panels is going to be extremely expensive without the proper coverage. You might also want to extend your RV insurance to cover any accidents that take place on your camping spots.

More: https://www.consumersadvocate.org/rv-insurance/best-rv-insurance

Dirt Bikes and Motorcycles

Much like your daily driver, a motorcycle needs to be fully insured before you ever take it on any public roadways. In some states, all dual-sport dirt bikes must be insured as well.

As for off-road dirt bikes, you will need to check your local laws. Some states don’t require insurance for off-road vehicles, but you might still want to consider limited coverage if you ride more than once or twice a year.

More: https://www.dirtrider.com/state-laws-for-dirt-bikes

Watercraft

Watercraft insurance is slightly different in every state, and you need to research all local laws before taking any type of boat out on the water. In some states, you must have watercraft liability insurance if your powerboat has more than 50 horsepower.

Others require insurance if you take your boat out on public lakes or rivers. As a general rule, kayaks and canoes don’t need to be insured.

More: https://www.boatus.com/newtoboating/do-i-need-boat-insurance.asp

Even if some of your vehicles are stored for most of the year, you still need to make sure that they are covered by at least one of your policies. If your home insurance policy doesn’t cover vehicles that are parked on your property, then you might want to invest in non-op or “storage” coverage.

Recent Comments